Recommendation Info About How To Check Your Federal Refund Status

Do you need to check the status of your refund?

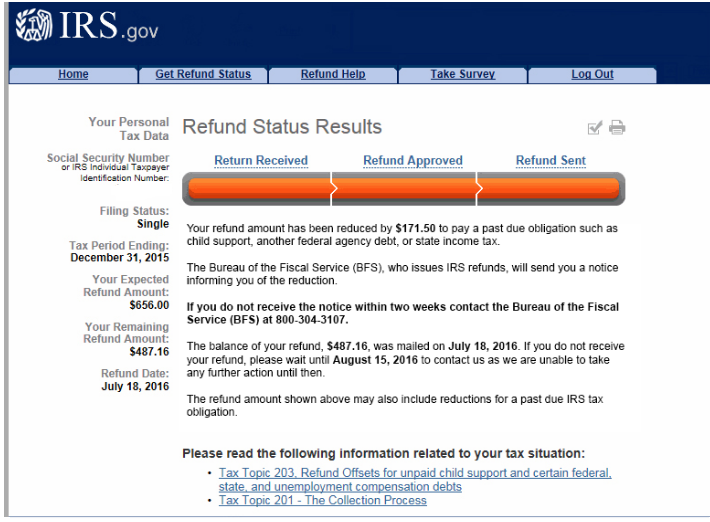

How to check your federal refund status. To check your refund status, you will need your social security number or itin, your filing status and the exact refund amount you are expecting. Check the status of your tax refund. Typically, the irs expects to issue nine out of.

Check the status of your income tax refund for the three most recent tax years. Status and make a note of your. Before checking on your refund, have the following ready:

The exact refund amount on your return. Find your tax information in your online account or get a copy (transcript) of your tax records. You can also check the status of.

The most convenient way to check on a tax refund is by using the where's my refund? You can check the status of your refund with the “where’s my refund?” tool or the irs2go mobile app. Other ways to check your federal refund status.

Learn about unclaimed tax refunds and what to do if your refund is lower than expected. Tool will give you detailed status messages. Couldn’t find your refund with our tool or you filed a paper copy.

Sign in to check your federal return. How do i track my state refund? Check your federal tax refund status.

That's down 12.8% from an average of $1,997. As of feb. To log in, you'll need your social security number, filing status and the expected amount of your refund.

9, the latest data available, the internal revenue service reported that the average refund was $1,741. If you are receiving a tax refund, check its status using the irs where’s my refund tool. You can view the status of your refund for the past 3 tax years.

What you need. Date of birth (mm/dd/yyyy) social security number. The where’s my refund?

Check your federal tax refund status. Check your refund status, make a payment, find free tax.

.png)