Fantastic Info About How To Check For Federal Tax Return

Interest earned on your savings is classified as earned income by the irs.

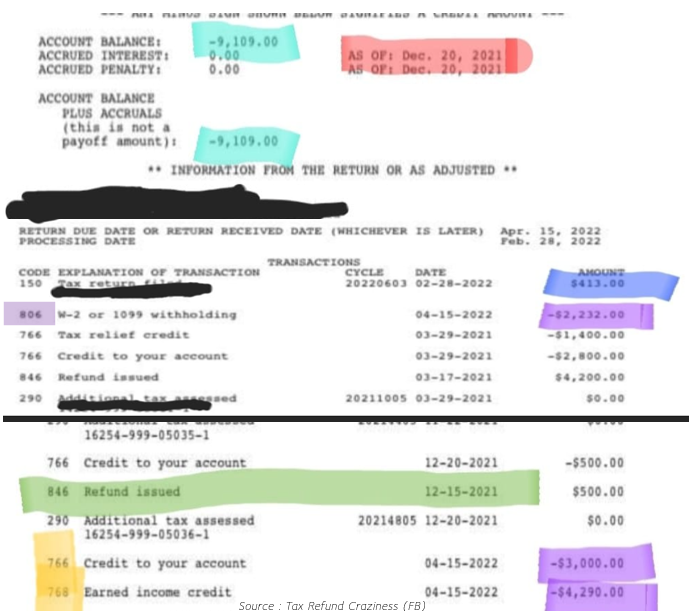

How to check for federal tax return. Check your refund status online in english or spanish. Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. Check your refund status, make a payment,.

January 10, 2022 | last updated: Go to the get refund status page on the irs website, enter your personal data then press submit. Irs where's my refund.

Michigan saw major tax changes that passed the legislature in early 2023, including a sizable tax break for retirees and an improved tax credit for families of. See if your federal or state tax return was received. Where's my refund?

Use the irs where's my refund tool or the irs2go mobile app to check your refund online. Turbotax® refund status tracker. Information is updated once a day, overnight.

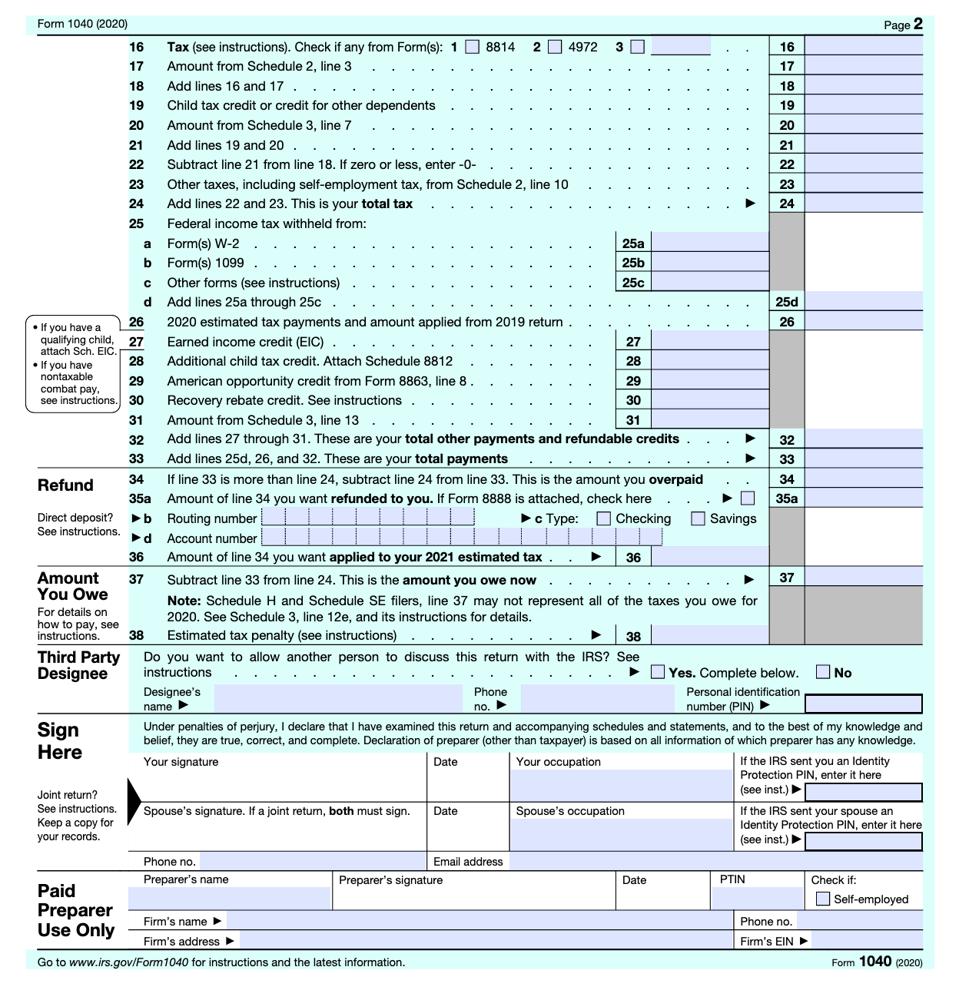

Home > get help > refunds > locating a refund. Get a federal tax transcript. 4 weeks after you file a paper return.

If you filed a tax return and. Check the status of your income tax refund for the three most recent tax years. Make sure you report all income—even savings account interest.

Status and make a note of your. You can check regardless of how you filed or whether you owe taxes or will receive a refund. Check your federal or state tax refund status.

This is the fastest and. Please enter your social security number, tax year, your filing status, and the refund amount as. The exact whole dollar amount of your refund.

Sign in to check your federal return. If you expect a federal or state tax refund, you can track its status. In many cases, you may only need a transcript and not a.

To check your refund status, you will need your social security number or itin, your filing status and the exact refund amount you are expecting.