Here’s A Quick Way To Solve A Info About How To Buy Interest Rate Swaps

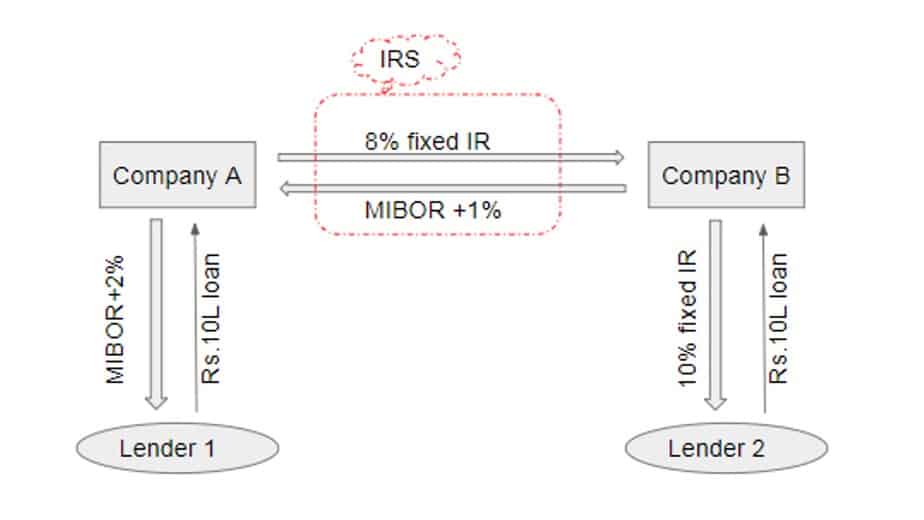

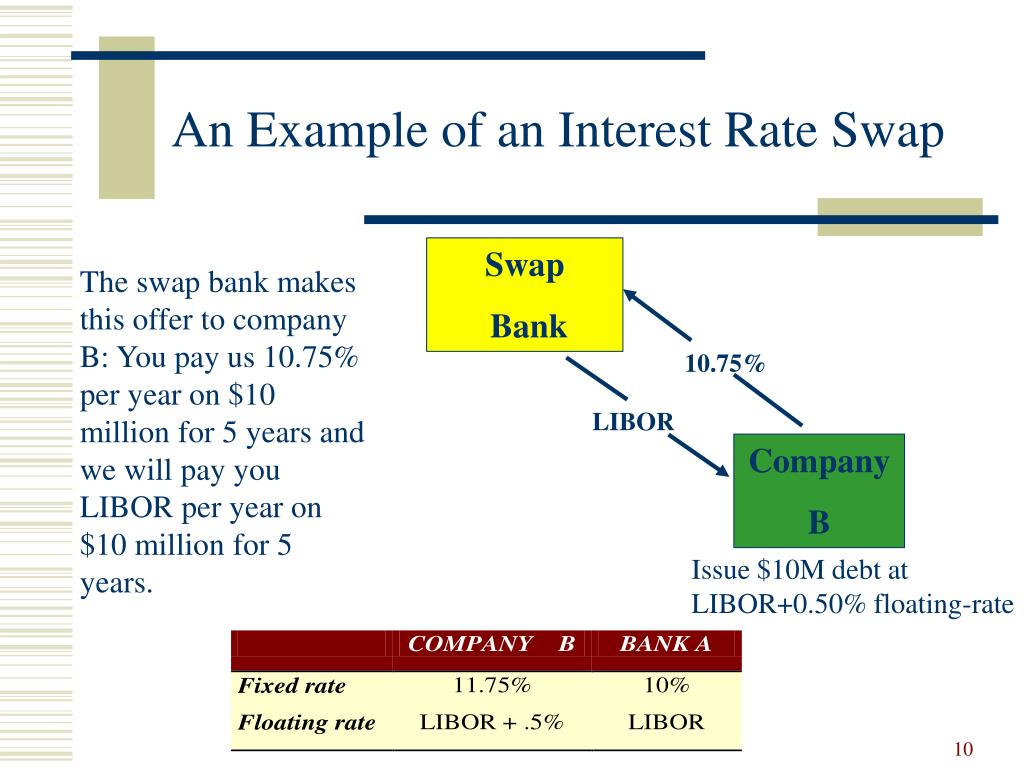

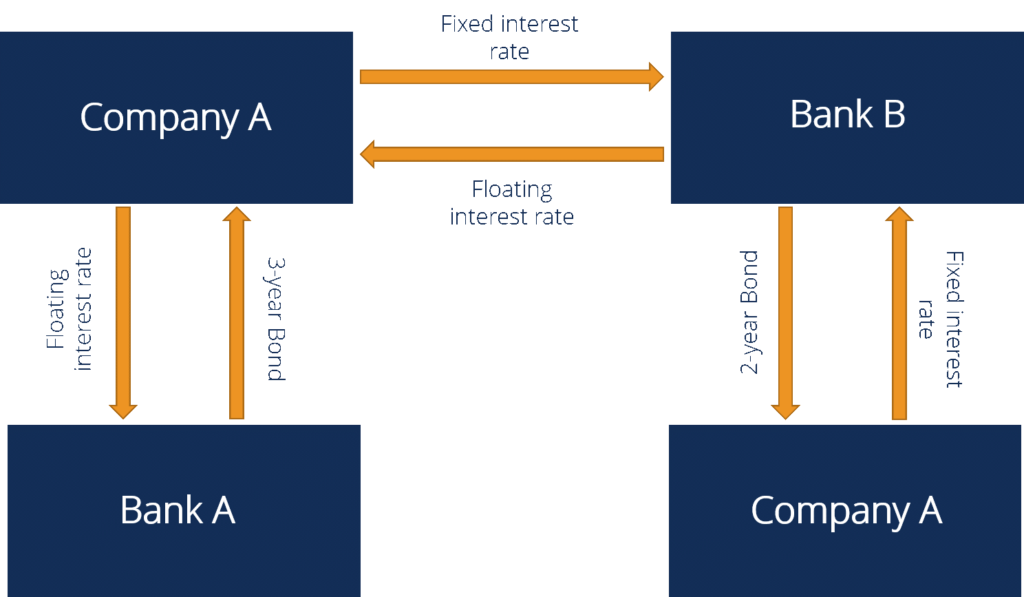

Interest rate swaps usually involve the exchange of a fixed interest rate for a floating rate, or vice versa, to reduce or increase exposure to fluctuations.

How to buy interest rate swaps. Benefits risks what is in it for an investor in the swap? Interest rate swaps are calculated so that a party, or company in this case, would be indifferent, at the moment the swap rate is calculated, to paying the fixed swap rate or. Courses on khan academy are always 100% free.

It does so through an exchange of interest payments between the. Interest rate swap vs currency swap frequently asked questions (faqs). Swaps are useful when one company.

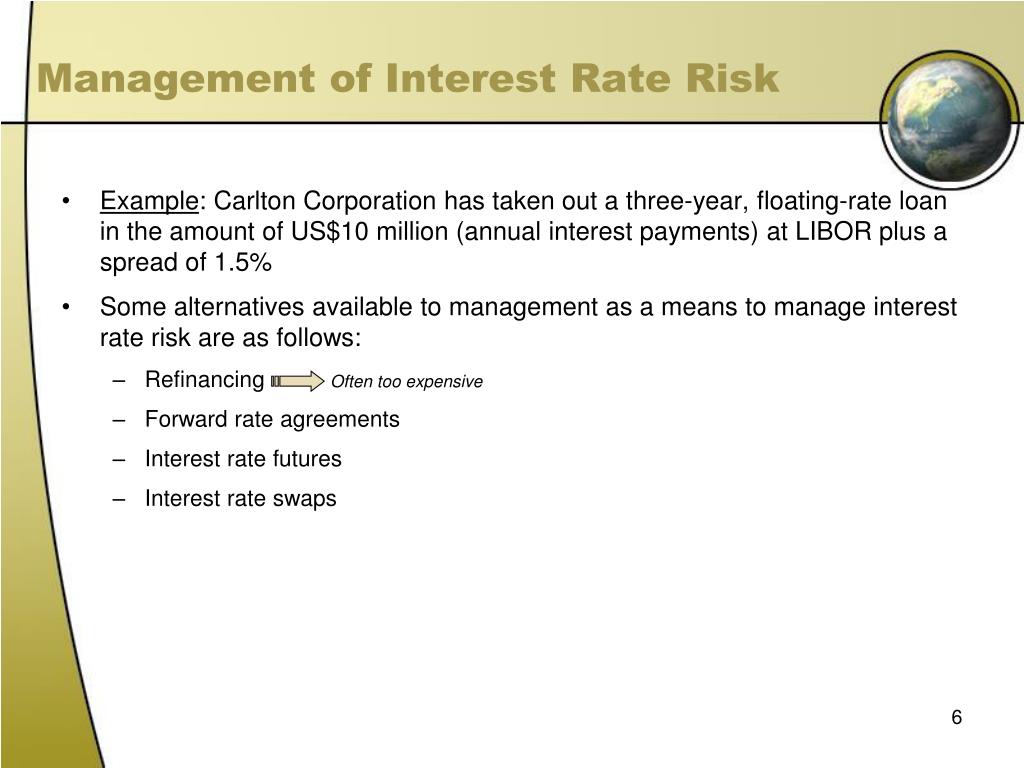

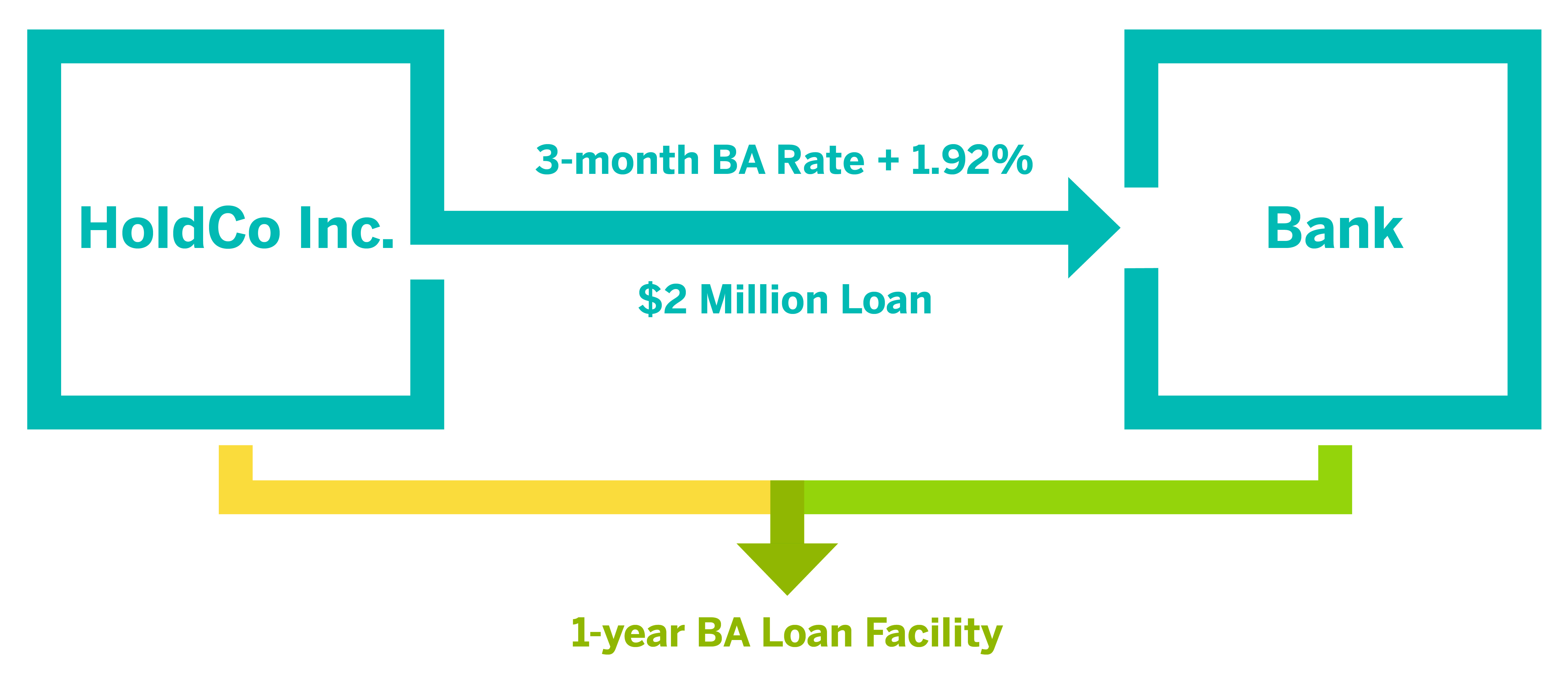

An interest rate swap is a forward contract in which one stream of future interest payments is exchanged for another based on a specified principal amount. From wikipedia, the free encyclopedia in finance, an interest rate swap ( irs) is an interest rate derivative (ird). Essentially, an interest rate swap turns the interest on a variable rate loan into a fixed cost.

An interest rate swap allows the parties involved to exchange their interest rate obligations (usually a fixed rate for a floating rate) to manage interest rate risk or to. An interest rate swap (irs) is a type of a derivative contract through which two counterparties agree to exchange one stream of future interest payments for another,. The common types of swaps are interest rate swaps, currency swaps, credit default swaps (cds), commodity swaps, equity swaps, total return swaps and.

Fact checked by yarilet perez swaps are derivative instruments that represent an agreement between two parties to exchange a series of cash flows over a. Swap curve who are the market makers? But like those who purchased six months earlier, the rate you'll earn on march 1 is now down to 3.94% if you purchased between may and august 2022, or 3.38% if.

An interest rate swap is a contract between two parties to exchange all future interest rate payments forthcoming from a bond or loan. Bottom line interest rate swaps are used by institutions and businesses to manage cash flows and interest rate exposure. Swaps involve the exchange of cash.

An interest rate swap is a financial derivative that companies use to exchange interest rate payments with each other. These swap varieties might exchange a floating rate. It involves exchange of interest rates between two.